Ever tried explaining your budget to your cat? Spoiler: it just blinked and walked away. Most people treat economics the same way- something distant, reserved for number-crunching folks in suits. But the truth is, economics is everywhere. Every salary, sale, and subscription has an economic story behind it. Understanding it isn’t about knowing jargon or complex equations; it’s decoding how the world influences your money, time, and even your Spotify playlists. It’s less about money and more about meaning. After all, if the world had once valued bread over cash, maybe our entire system would’ve revolved around a loaf instead of a note. And that’s a game we all play-whether we notice it or not.

Section 1: Sneaking in your DAY

Money Talks: Language We All Speak

Everyday life is full of economic choices. When you head out for grocery shopping or plan your next vacation, there’s always an unspoken calculation going on-how to make your money stretch farther. Picking between brands at the supermarket? That’s less about taste and more like choosing your favourite superhero: both promise great things, but only one gives you true value for your hard-earned cash.

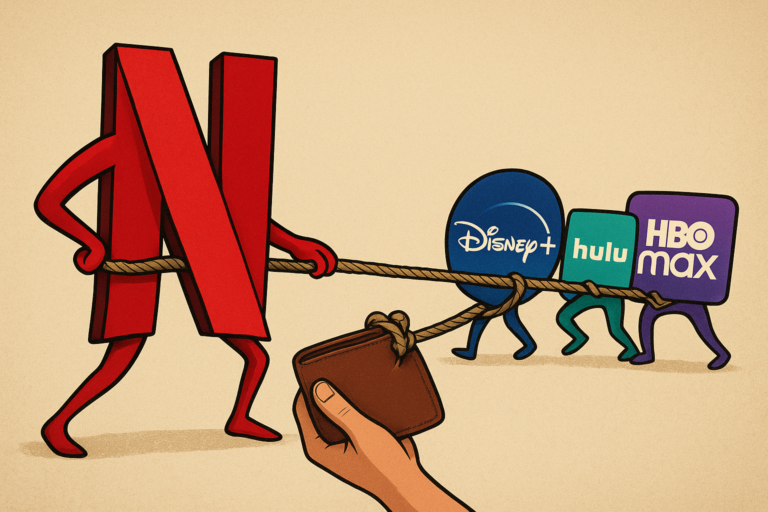

For example, Netflix’s regular price increases are a smart business move because we love binge-watching and there is a lot of competition among streaming services. Netflix knows how hard it is to resist those shows, so it changes its prices to stay ahead of the competition, like Disney+. They’re not being greedy; they’re responding cleverly to what viewers are willing to pay.

Fig: “Your Binge Habits shape the PRICE you pay.”

Your budget is more than just numbers- it guides your choices. Dividing expenses across groceries, entertainment, transport, and savings helps reduce stress and gives you more freedom. Being familiar with basic economic ideas makes it easier and less stressful to keep track of your monthly spending.

So, when you have to choose between local snacks or imported treats or pay for a subscription, keep in mind that these small choices are part of a bigger economic picture. You can make your money work smarter for both fun now and plans for the future if you are aware.

Section 2: Behind the Current Trends

Moving over, ever notice how a viral TikTok challenge or dance suddenly causes everything around it- like fashion accessories or gadgets – to fly off the shelves? This is a clear example of demand in action. When everyone wants the latest Bluetooth earphones or smart water bottles because they’re featured in popular videos, prices for those items often shoot up. Like a busy Indian market during the holidays, there are more buyers than sellers, which drives prices up! Sellers also know this, so they raise prices because they see how prominent it is across the country.

Fig: “When a dance trend costs you $50”

These trending waves aren’t just fun moments on social media; they are real economic forces. They demonstrate how rapidly changes in consumer preferences can alter availability and prices. So, whenever you spot a viral product that suddenly becomes expensive or is completely sold out, remember that its consumer demand creates a ripple effect in the economy. This demand is shaped by what’s popular today and what fades away tomorrow.

Now even my GRANDMA also talks about INFLATION.

The word Inflation might sound like a big, boring word, but it’s just price increases that sneak into your daily life like that friend who always borrows money and never pays it back. Even Grandma notices when the cost of vegetables or groceries increases each month. This impacts how much you pay for things like rent, bills, and even your Netflix subscription every month. When you know about inflation, you can plan your savings and spending so that you aren’t surprised when prices go up.

Fig: “Grandma’s side eye. You know it’s serious.”

“Relatively simple, isn’t it?” Now, let’s look at the two main branches of economics, which shape our world in ways you might not expect.

Section 3: Battle of Big & Small

Let’s take a closer look at how economics affects our choices and the world around us. We look at the economy mainly through two lenses: microeconomics and macroeconomics.

Microeconomics: The Small Stuff

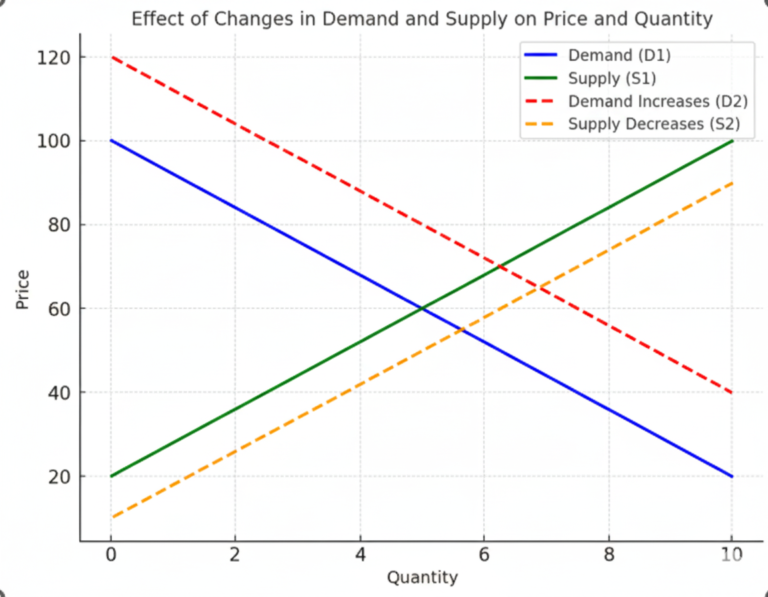

Microeconomics studies the choices made by people, families, and small businesses—people you see every day. What to buy, how much to spend, and how businesses set their prices are all choices. Prices go up when everyone wants the newest Bluetooth earbuds that are shown in viral videos. This is because demand goes up, just like the red dashed line. But in the summer, when you’ll find a lot of strawberries in the market, their prices go down. This is the supply at work (shown by the yellow dashed line).

Microeconomics helps us understand more than just goods; it also helps us understand everyday choices. Why would you choose a ₹300 café coffee over a ₹50 roadside tea? People make these choices based on their tastes, the prices, and what they think the item is worth. Microeconomics helps businesses decide what to make, how much to charge, or what new items to add to their menus. A burger shop that offers discounts on Mondays, for instance, is using micro strategies to get more customers when business is slow.

Fig:” Welcome to the daily drama of Demand & Supply”

Macroeconomics: The Big Picture

Now, zooming out, Macroeconomics looks at the whole economy, including countries, government policies, and global markets. This is where words like inflation, GDP, unemployment, and trade come in. GDP tells us if a country’s economy is getting better or worse. Inflation is the reason why the same groceries cost more this year than last year. Deflation is the opposite of inflation. This is why some things, like electronics, might get cheaper over time.

The number of unemployed people shows how many people have jobs, which is a good sign for the economy. Governments guide the economy by changing taxes, interest rates, and spending programs. Macroeconomics also looks at trade between countries, which is why many things in your home say “Made in China.”

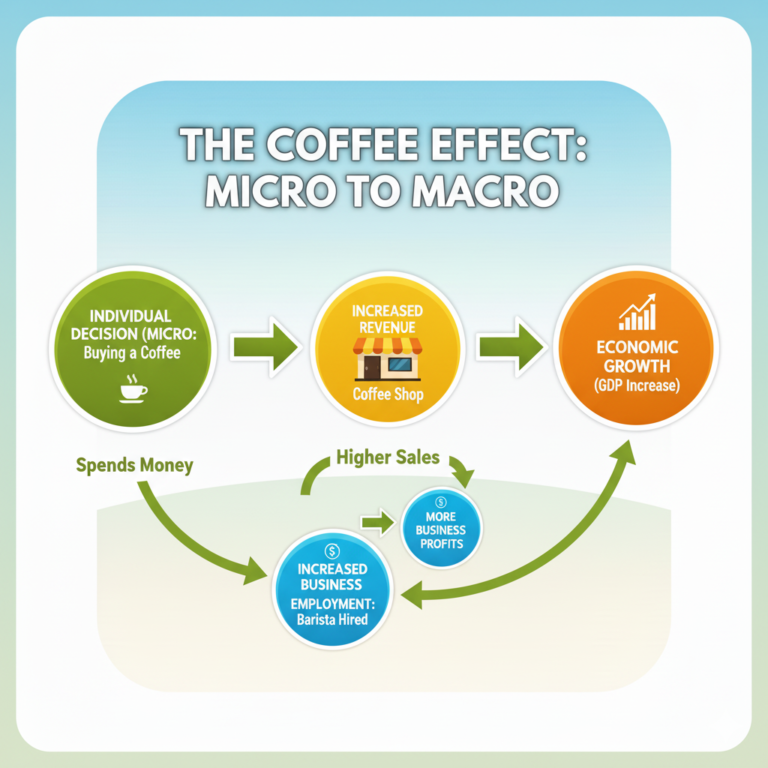

Fig: “Who knew my latte addiction was so patriotic”

The link: both types of “economics” function as two components of a single system. Your decision to buy a cup of coffee reflects microeconomic behaviour, but when thousands make similar purchases, it contributes to wider trends like business growth, employment, and national income. Know-how of both perspectives can help better grasp the minute details with the big trends moulding our financial world.

Section 4: Lights, Camera, Economics!

Hollywood has a fascination with money—and for good reason! Films like The Big Short, The Wolf of Wall Street, and Moneyball turn financial chaos, smart investments, and economic risk into high-energy drama that you can stream from your sofa. They show us that economics isn’t just about textbooks or number crunching; it’s what decides who wins, who loses, and who ends up buying the fancy car. If you thought investing was as simple as picking random stocks, watching The Big Short proves it’s a wild gamble—just with better-dressed gamblers.

Fig: “Nailed the landing… mostly”

But movies aren’t the only ones holding up a mirror to our financial reality. Jumping from the stock market to South Korea, Squid Game takes economic struggle to an extreme. Players who are buried in debt play dangerous games, hoping for a do-over on life. Being in debt isn’t just stressful – it can be like playing “red light, green light” with your life. It’s an intense (and occasionally savage) reminder that when the money stops, the consequences can be more cinematic than any action scene.

Fig: “Pretty sure my landlord wants me to play this game”

Both Hollywood and world pop culture tell economic narratives to remind us of the true power of money: that the struggle, drama, and aspirations they illustrate begin with mundane financial decisions.

Section 5: Your Money, Your Move

While pop culture illustrates how economics influences narratives on television, the most immediate platform is your own life. Each time you save, invest, or budget, you’re living economics firsthand.

Your Wallet: The Real Star of the Economy

Choosing what to spend, save, and invest your money reflects simple economic concepts such as trade-offs and opportunity costs. Budgeting is similar to dieting – everyone knows they should do it, but somehow pizza always comes out on top. Keeping an eye on your money illustrates how little choices compound, defining your life and associating you with greater economic trends.

Fig: “This is why Adulting has been hard since”

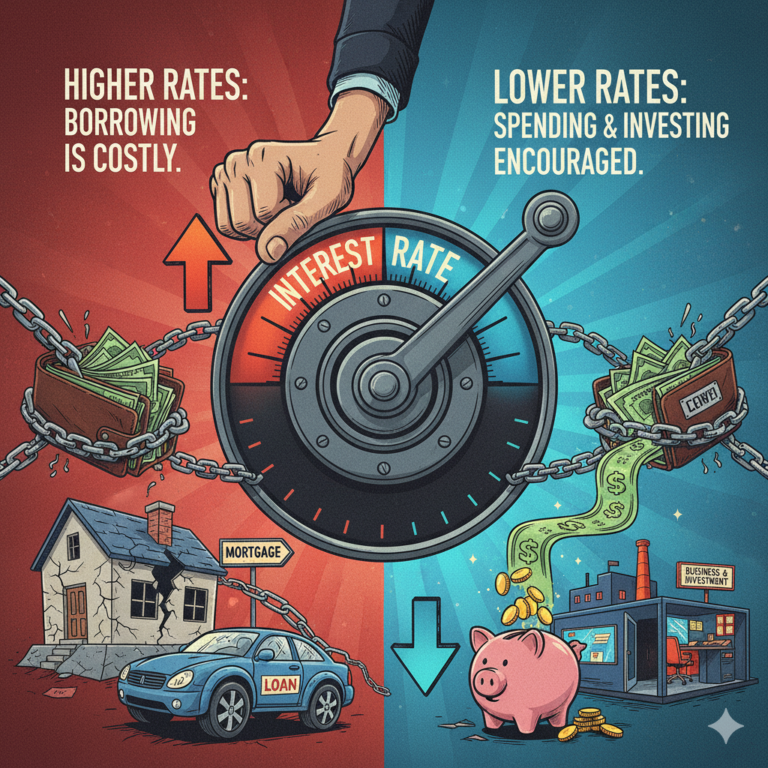

Why Care About Interest Rates (Even If You Hate Math)

Interest rates influence loans, mortgages, and credit cards. Increasing rates make borrowing expensive; decreasing rates spur spending and investment. They’re like that pesky ex – you don’t even think of them until they begin meddling in your life.

Personal finance is where micro and macro meet. From the coffee each day to the savings over the years, personal finance shows us how resources flow and priorities are established in the real world.

Fig: “Harder to Track than my Mood”

Conclusion

By now, it should be clear that Economics is in contact with every aspect of our lives – morning coffee, monthly budget, retirement fund. It’s an influential roadmap for making spending, saving, and investing decisions. The more you know about these economic forces, the more confident you’ll be in directing your financial future.

So, next time you go shopping or binge-watch a show, take a moment to think about the economics involved – you might discover ways to save a few bucks! Keep in mind that economics isn’t all about markets; it’s about your everyday life and choices.

Can you really afford to ignore economics now that you know it permeates everything, from your wallet to your Netflix subscription?

Do let us know by leaving your opinions or money-saving advice below!