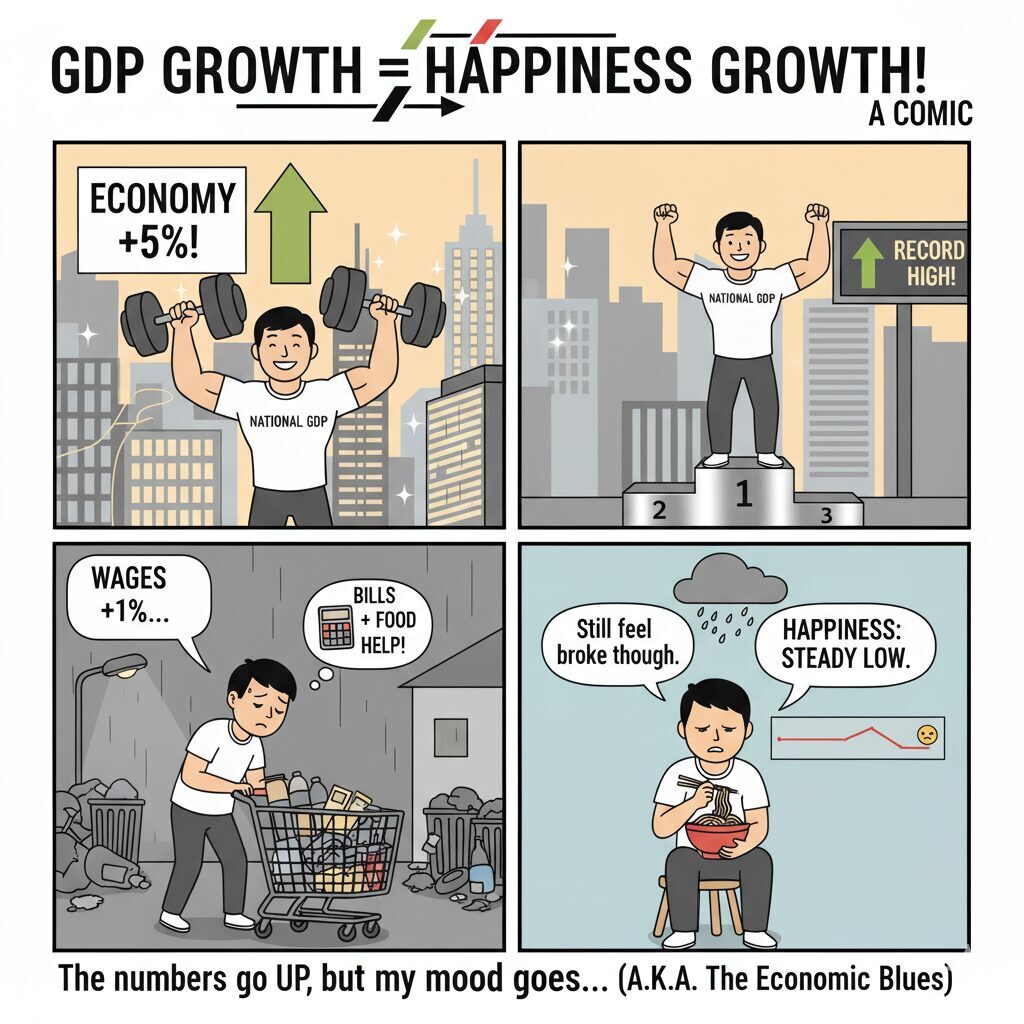

Every now and then, headlines announce that India’s economy is soaring, GDP breaking records, and analysts celebrating the country’s growth story. It feels like a national victory lap. Yet, while the economy seems to sprint, many people still glance at their grocery bills and wonder if the boom forgot their street.

Economic growth is supposed to mean more production, jobs, and income. When an economy grows, more opportunities should appear, and life should get easier. In theory, it’s that simple. But the reality often writes its own plot twist. The charts keep climbing, the optimism fills speeches, and somehow, the comfort doesn’t follow. Which leaves a question worth asking – if the nation is growing so much richer, why do so many feel stuck?

What Economic Growth Actually Means

Every few months, new GDP numbers arrive like national report cards. GDP, or Gross Domestic Product, measures everything a country produces in a year- cars, clothes, apps, even street food. If the total is larger than last year, it’s called Growth.

But here’s the catch: just producing more doesn’t mean everyone benefits. Imagine your college canteen sells twice as many samosas this semester. Sounds great for growth – except it might just be one student with a bottomless appetite. Everyone else is still waiting hungry.

That’s the difference between growth and development. Growth tells us how much more the economy produces, while development asks whether people’s lives are improving. It shows up in classrooms that actually have working fans, hospitals within reach, jobs that pay enough, and prices that don’t sabotage monthly budgets.

So next time GDP rises, the real question isn’t how big the number is – it’s whether the average person feels the change. Real growth isn’t about more buildings or factories; it’s about more opportunities that actually reach those who need them.

Where the Money Goes — The Distribution Problem

Economic growth is often announced like a collective success story: the country doing better, everyone happier. But that’s where the illusion begins. A country’s income can rise even when most people’s incomes don’t. Imagine a city where one large company earns billions while everyone else’s earnings stay flat. GDP grows – but inequality deepens.

India’s data paints that picture sharply. The richest 10 percent earn over half of the total income, while the bottom half shares less than 15 percent. The top one percent makes several times more than the poorest half combined. That means when the economy grows, gains often cluster at the top.

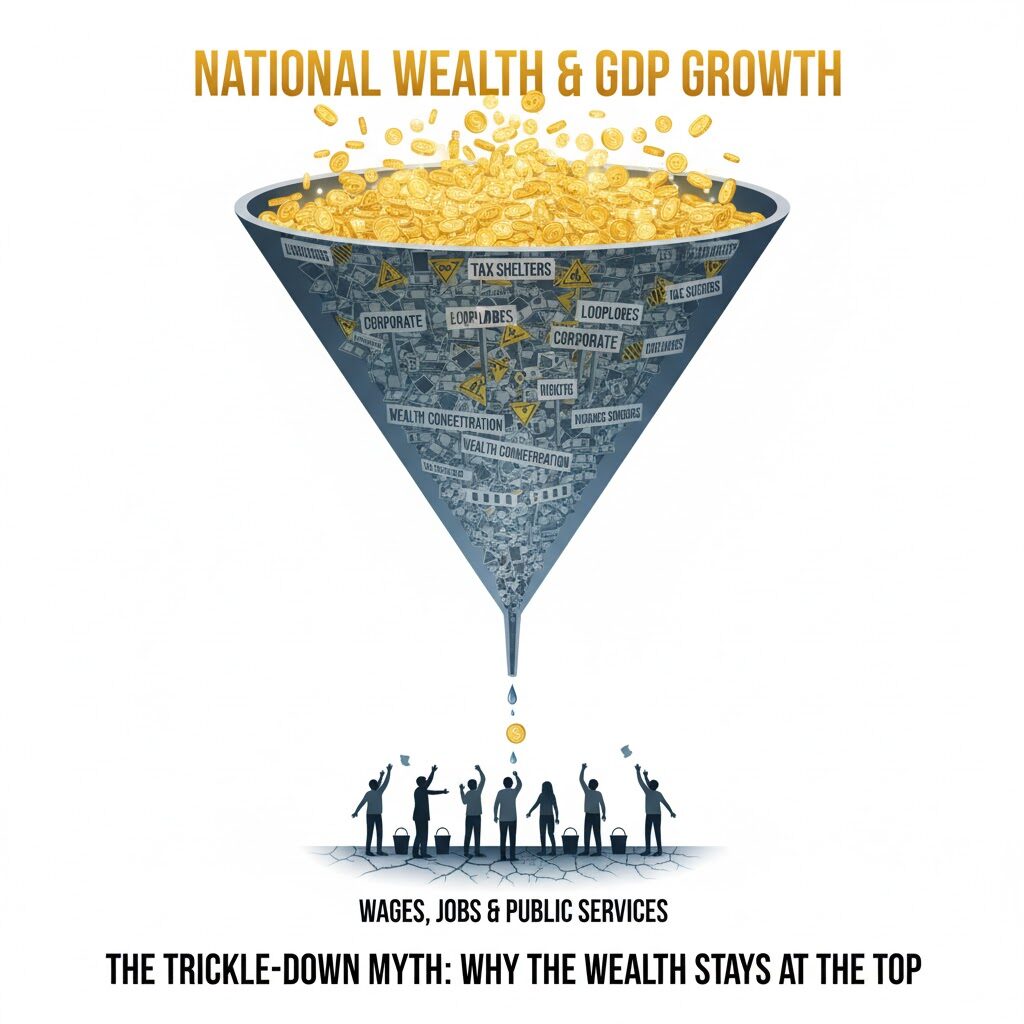

The same happens globally. In the United States, the top one percent holds most of the stock market wealth, while average workers’ pay hasn’t grown much in decades. The “trickle-down” idea – that wealth created by the rich will eventually benefit all – sounds comforting but rarely works that way. Money tends to stick where it starts.

This disparate sharing makes it seem like growth is far away for people with lower and middle incomes. In the absence of social investment, fair taxation, or robust labour rights, expansion serves the interests of the winners. Growth that leaves the majority of the population behind is not a success; rather, it is an imbalance masquerading as advancement.

Growth that Misses the People

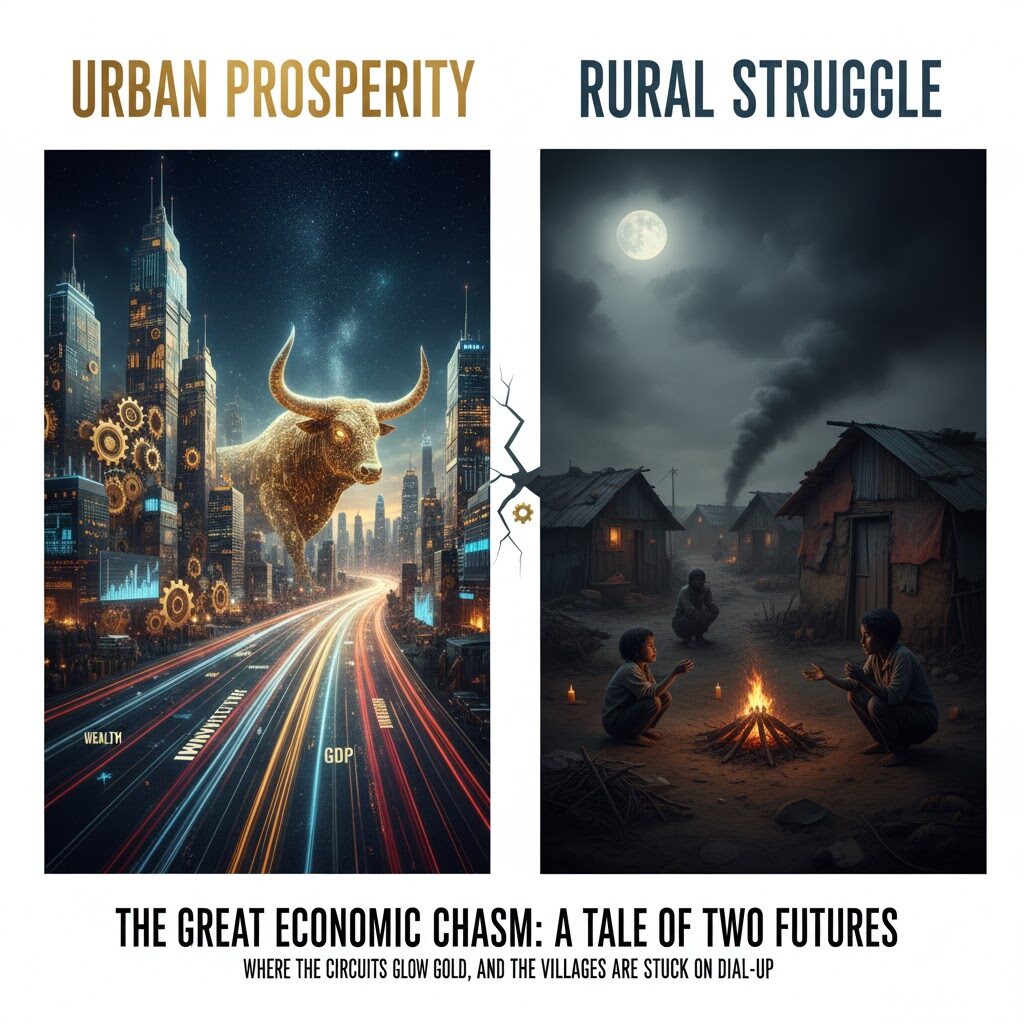

Rapid growth does not always translate into a decline in poverty. The overall output of the economy can occasionally increase while the majority of people’s living standards remain unchanged. India’s GDP has increased gradually, but job growth has lagged behind. Finding a job that pays enough to live comfortably is a challenge for many recent graduates. Prosperity headlines rarely mention rising job uncertainty or unpaid internships.

This is what economists call “Jobless Growth.” Productivity soars, technology advances, and businesses automate – but human workers get fewer opportunities. Picture a university’s admission office that brings in an AI to process forms instantly. Efficiency improves, but the student part-timers who relied on that job now have none.

China, on the other hand, combined fast growth with deliberate poverty reduction by creating mass employment and investing in rural development. That’s what made its growth inclusive rather than one-dimensional.

Inequality also shows up in smaller, quieter ways: city dwellers with better infrastructure, connectivity, and access to education, while rural areas lag; women get paid less for the same work even with equal qualifications. So, while the GDP graphs rise, millions still feel trapped in the same struggle.

Growth that doesn’t yield larger job opportunities, better healthcare, and quality education will eventually lack significance. Progress can’t be explained with numbers alone. Progress must also lead to a strengthened sense of security and hope for everyday living.

Growth at a Cost – When the RICH get RICHER

Here is another unpleasant truth: the more rapidly a nation develops, the more rapidly inequality can increase (if any wealth generated is not distributed justly). When profits rise, it is the investors and owners of businesses, real estate, or stock that gain the most. Everyone else is left trying to figure out how to make their paychecks work in a time of increasing prices.

For example, imagine a tech company that has its valuation doubled on the stock market. Shareholders, any employees aside, are ecstatic about this valuation leap but no employees’ pay would change. Growth is one way that superior wealth is created and literally valued to owners of assets far more than manual labor wage earners.

We now arrive at the concept of ‘Wealth Concentration:’ wealth concentration refers to a smaller number of wealthy individuals owning a greater proportion of total wealth as wealth grows. India has examples of wealth concentration where booming real estate markets lead to rising housing rents, and rising numbers of millionaires, while low- and middle-income individuals experience rent increases and are pushed further into poverty. A huge percentage of financial assets in the United States are held by a small number of very wealthy owners, furthering wealth concentration, and wage gaps.

Even GDP growth doesn’t differentiate between types of spending. A billionaire buying a private jet contributes to GDP just as much as building hundreds of affordable houses. Both “grow” the economy, but only one clearly improves lives. Growth numbers celebrate both equally, though their real-world effects are wildly different.

That’s why economists stress not just growth, but how fairly its gains are distributed. A booming economy where only a few thrive is like a party where half the guests were never invited.

What REAL Growth Should Look Like

Real progress goes beyond impressive GDP numbers. Growth doesn’t just grow. It empowers. Economists refer to it as Inclusive Growth – growth that raises the living standards of many while expanding opportunities. The three pillars of inclusive growth are Equity, Jobs and Education. It ensures equity of opportunity for every citizen to participate and benefit.

In South Korea, for example, public investments in healthcare and education enabled the transition of millions out of poverty and into a skilled worker class. Costa Rica demonstrated that prosperity and progress can be combined by making heavy investments in environmental sustainability and universal healthcare.

India’s own programs illustrate some similar potential. Millions of people in rural parts of India are able to receive supplemental housing from generated employment under the Mahatma Gandhi National Rural Employment Guarantee Act and school attendance and nutrition is improved through the Mid-Day Meal Scheme and supplemental school attendance grants.

Sustainability is equally critical. Economic expansion that damages the environment ends up sabotaging future growth itself. The same applies to inequalities stemming from gender and region which inhibit progress overall. Inclusive growth accounts for balance—access to education, health care, and fair, living wages for all. When growth lifts us all, instead of tearing us apart, we have a society that feels wealthier materially, socially, and emotionally.

Conclusion

We don’t need everyone to become billionaires for a country to prosper. We just need fair systems that share the prosperity sensibly. Education that empowers, wages that sustain, and healthcare that protects are the most reliable guarantees of inclusive prosperity.

Fair taxation means the rich pay their proportionate share in financing public goods for all. Places like Scandinavia illustrate how one can have equity with growth: Universal Healthcare, Quality Education, and Strong Welfare Systems.

India has taken promising steps in this direction through rural employment, schooling, and digital inclusion programs. The challenge remains in consistency and reach – ensuring progress is not just visible in data, but felt in kitchens, paychecks, and communities.

Think of economic growth like PIZZA: great that the pizza is getting bigger, but it’s meaningless if only a few get full slices while most have to settle for the crumbs. Everyone deserves a fair portion, not just the crust.

So, the next time you come across another record GDP number, do not just marvel at the chart. Ask yourself this simple question: Is my slice growing too?